An export employer record identifies the employer whose wage and tax information is being reported in an export totals file.

Create an export employer record

Create an export employer record

- In the Navigation pane, highlight the Payroll/Human Resources > Setup > Export Employers folder.

- Click

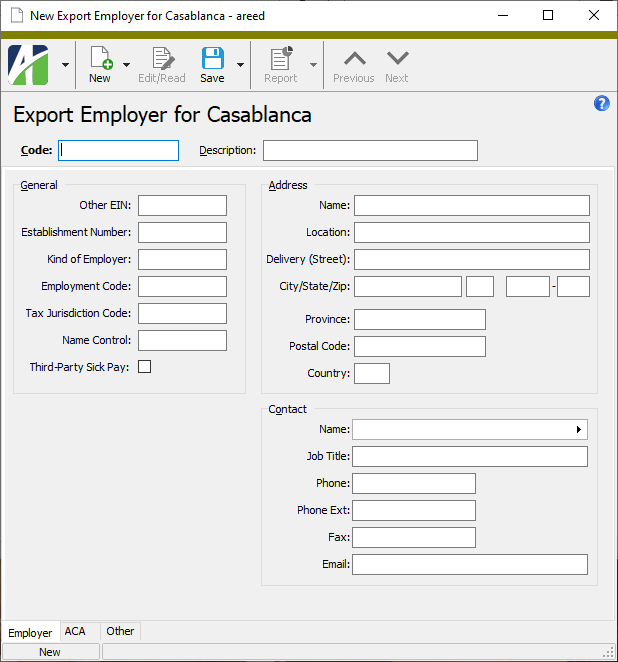

. The New Export Employer window opens.

. The New Export Employer window opens.

- Enter a unique Code for the export employer.

- Enter a Description of the export employer.

- If you need to enter an alternate EIN, enter it in the Other EIN field. If you have used an EIN (including a prior owner's EIN) on Form 941, Form 943, Form 944, or Form CT-1 that is different from the EIN reported on Form W-3, enter that EIN here. In general, you will leave this field blank and report the employer's EIN.

-

The Establishment Number can be used to identify separate establishments in your business. For instance, you can use the establishment number to distinguish store or factory locations or to separate different types of payroll. You can file separate Forms W-3 with Forms W-2 for each establishment even if they all have the same EIN, or you can use a single W-3 for all Forms W-2 of the same type. The establishment number identifies each location (defined by an employer reporting under the Establishment Reporting Plan). The Establishment Reporting Plan is an optional reporting method used by some employers with more than one location or type of business. The Social Security Administration no longer requires or uses this data (except for uniformed military service employees). This field has also been used for a Payroll Record Unit (PRU), but is not applicable for tax years 1987 and later.

If neither of the situations above applies, you can leave this field blank. Otherwise, enter the establishment number using any combination of blanks, numbers, or letters.

- In the Kind of Employer field, enter the appropriate code for the export employer. This code is required for electronic reporting (EFW2). Valid codes include:

- F - Federal government

- S - State and local government employer

- T - Tax exempt employer

- Y - State and local tax exempt employer

- N - None apply

- Enter the appropriate Employment Code for the export employer. R is the most commonly used code. Valid codes include:

- A - Agriculture (Form 943)

- H - Household (Schedule H)

- M - Military (Form 941)

- Q - Medicare Qualified Government Employee (Form 941)

- X - Railroad (CT-1)

- F - Regular (Form 944)

- R - Regular (all others) (Form 941)

- If the export employer is located in a U.S. territory, enter the Tax Jurisdiction code for the export employer. Valid codes include:

- V - Virgin Islands

- G - Guam

- S - American Samoa

- N - Northern Mariana Islands

- P - Puerto Rico

- If the export employer is transmitting Form 1095-C information to the IRS and the IRS issued the employer a four-character name control code when it provided the employer with an EIN, enter the code in the Name Control field. This field is optional, so if you're unsure of the code, leave this field blank. The IRS may reject your transmission if the value doesn't match their records.

- If the export employer is a third-party sick pay payer filing a Form W-2 for an insured's employee or is reporting sick pay payments made by a third party, mark the Third-Party Sick Pay checkbox.

- In the Address section, enter address information for the export employer. Use the Location field to provide specific address information such as a suite number or room number. Use the Delivery (Street) field to provide a street address or post office box. For employers in the United States, leave the Country field blank.

-

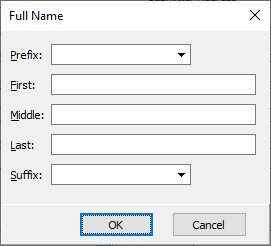

In the Name field, enter the export employer's contact's full name or click the right arrow to open the Full Name dialog box where you can enter the name in parts.

The Name field and the Full Name dialog box are synced so that changes you make to one are updated to the other.

- In the remainder of the fields in the Contact section, provide job title, phone, fax, and email information for the export employer's contact person. If the export employer is used for ACA reporting, the Job Title field is used to provide the title on the first page of Form 1094-C.

-

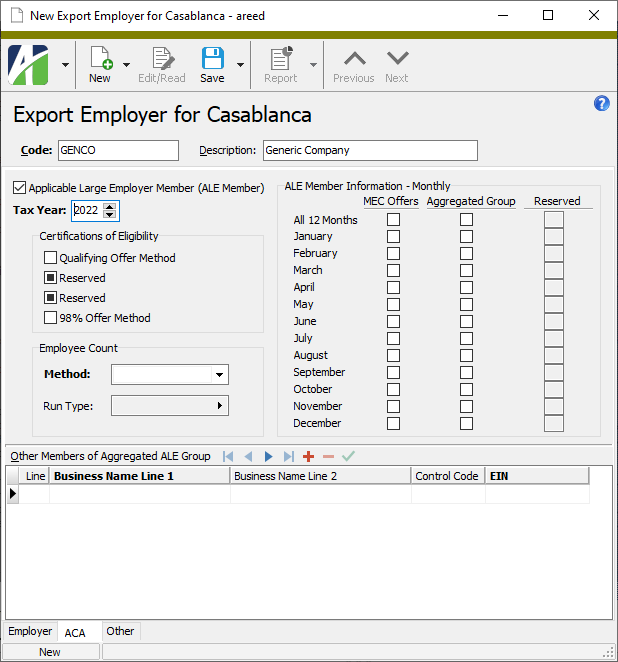

If this employer uses ActivityHD to track and report Affordable Care Act (ACA) information, select the ACA tab and mark the Applicable Large Employer Member checkbox. Otherwise, skip to step 27.

- Enter the four-digit Tax Year for ACA reporting.

- Mark the Qualifying Offer Method checkbox to certify the employer is eligible to use and is using the Qualifying Offer Method to report Form 1095-C information for one or more full-time employees for all months during the year for which the employee was a full-time employee for whom the employer shared responsibility payment could apply.

-

If you entered "2016" or later in the Tax Year field, the next checkbox is labeled Reserved and is disabled.

If you entered "2015" in the Tax Year field, the next checkbox is labeled Qualifying Offer Method Transition Relief. Mark this checkbox to certify the employer is eligible to use and is using the Qualifying Offer Method Transition Relief to report 1095-C information for one or more full-time employees. To qualify for this relief, the employer must make a Qualifying Offer for one or more months of 2015 to at least 95% of its full-time employees.

-

If you entered "2017" or later in the Tax Year field, the next checkbox is labeled Reserved and is disabled.

If you entered "2016" or earlier in the Tax Year field, the next checkbox is labeled Section 4980H Transition Relief. Mark the checkbox to certify the employer is eligible to use and is using the Section 4980H Transition Relief for employers with fewer than 100 employees or for employers with 100 or more employees. If you mark the checkbox, you must also specify which relief you are claiming in the Section 4980H column of the ALE Member Information - Monthly section.

- Mark the 98% Offer Method checkbox to certify the employer is eligible to use and is using the 98% Offer Method to report Form 1095-C information. To qualify to use this method the employer must offer affordable health care coverage providing minimum value to at least 98% of its employees for whom it is filing a 1095-C employee statement and must also offer minimum essential coverage to those employees' dependents.

- From the Method drop-down list, select which day to report the monthly total employee count for. The total employee count includes full-time employees, non-full-time employees, and employees in a Limited Non-Assessment Period. Your options are:

- Month Begin

- Month End

- Month Day 12

- Pay Period Begin. The first day of the first pay period during the month.

- Pay Period End. The last day of the first pay period during the month.

- The Run Type field is enabled if you select "Pay Period Begin" or "Pay Period End" in the Method field. Select the payroll run type that is associated with the pay periods you want to use to determine the total employee count.

- In the MEC Offers column of the ALE Member Information - Monthly section, mark the checkbox(es) which correspond to the months in which the employer offered minimum essential coverage (MEC) to at least 95% of their full-time employees and their dependents. If the employer offered MEC to at least 95% of their full-time employees and their dependents for all twelve months, mark the All 12 Months checkbox.

- In the Aggregated Group column, mark the checkbox(es) which correspond to the months in which the employer was a member of an Aggregated ALE Group. If the employer was a group member for all twelve months, mark the All 12 Months checkbox.

-

If you entered "2017" or later in the Tax Year field, the third column in the ALE Member Information - Monthly section is labeled Reserved and all text boxes in the column are disabled.

If you entered "2016" or earlier in the Tax Year field and if you marked the Section 4980H Transition Relief checkbox in the Certifications of Eligibility section, the third column is labeled Section 4980H and the text boxes in the column are enabled. For each month the employer is claiming relief, enter the code for the type of relief being claimed. If relief is being claimed for all twelve months, enter the code in the All 12 Months text box. Valid codes are:

- A. The employer is eligible for 50 to 99 Relief.

- B. The employer is eligible for 100 or More Relief.

An employer cannot be eligible for both types of relief.

-

If any of the checkboxes in the Aggregated Group column in the ALE Member Information - Monthly section are marked, the Other Members of Aggregated ALE Group table is enabled. Enter information about the other members of the Aggregated Group the employer belongs to. Enter the group members in descending order starting with the group member with the highest average monthly number of full-time employees.

Note

If any member of the Aggregated Group uses the 98% Offer Method, all members of the Aggregated Group should report the average monthly number of total employees rather than full-time employees.

Enter the following information for each group member:

- In the Business Name Line 1 column, enter the first line of the group member's business name.

- If needed, in the Business Name Line 2 column, enter the second line of the group member's business name.

- In the Control Code column, enter the control code assigned to the group member.

- In the EIN column, enter the group member's employer identification number (EIN) including the dash.

- Save the new export employer record.

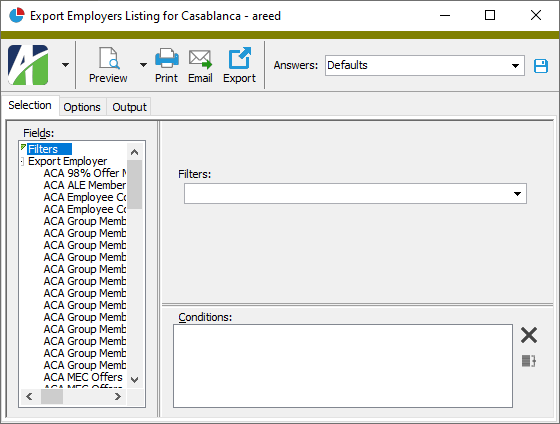

Export Employers Listing

Purpose

The Export Employers Listing provides a list of the export employer records defined in Payroll.

Content

For each export employer record included on the report, the listing shows:

- description

- other EIN

- establishment number

- kind of employer

- employment code

- tax jurisdiction

- name control code

- third-party sick pay indicator.

In addition, you can include one or more of the following:

- address information

- ACA information

- other members of an Aggregated ALE Group the employer belongs to

- timestamps

- memos

- custom fields.

The following total appears on the report:

- record count.

Print the report

- In the Navigation pane, highlight the Payroll/Human Resources > Setup > Export Employers folder.

- Start the report set-up wizard.

- To report on all or a filtered subset of export employers:

- Right-click the Export Employers folder and select Select and Report > Export Employers Listing from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected export employers:

- In the HD view, select the export employers to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

.

.

- To report on a particular export employer record from the Export Employer window:

- In the HD view, locate and double-click the export employer to report on. The Export Employer window opens.

- Click

.

.

- To report on all or a filtered subset of export employers:

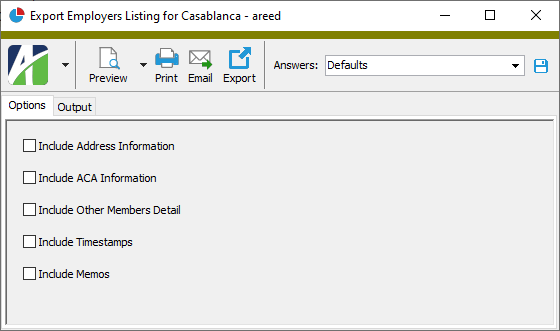

- Select the Options tab.

- Mark the checkbox(es) for the additional information to include:

- Address Information

- ACA Information

- Other Members Detail

- Report Options. To include a section at the end of the report with the report settings used to produce the report, leave the checkbox marked. To produce the report without this information, clear the checkbox.

- Timestamps

- Memos

- Custom Fields (only visible if custom fields are set up)

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extensions are available for the report:

- Export employers

- ACA group members

Export Employer Record ID

Employer tab

- F - Federal government

- S - State and local government employer

- T - Tax exempt employer

- Y - State and local tax exempt employer

- N - None apply

- A - Agriculture

- H - Household (Schedule H)

- M - Military (Form 941)

- Q - Medicare Qualified Government Employee (Form 941)

- X - Railroad (CT-1)

- F - Regular (Form 944)

- R - Regular (all others) (Form 941)

- V - Virgin Islands

- G - Guam

- S - American Samoa

- N - Northern Mariana Islands

- P - Puerto Rico

ACA tab

Complete this tab if you use ActivityHD to track and report Affordable Care Act (ACA) information for the employer. This information is used to complete Form 1094-C.

If you entered "2016" or later in the Tax Year field, this checkbox is labeled Reserved and is disabled.

If you entered "2015" in the Tax Year field, this field is labeled Qualifying Offer Method Transition Relief. If this checkbox is marked, you certify that the employer is eligible to use and is using the Qualifying Offer Method Transition Relief for 2015 to report Form 1095-C information for one or more full-time employees. To qualify for this relief, the employer must make a Qualifying Offer for one or more months of 2015 to at least 95% of its full-time employees.

If you entered "2017" or later in the Tax Year field, this checkbox is labeled Reserved and is disabled.

If you entered "2016" or earlier in the Tax Year field, this checkbox is labeled Section 4980H Transition Relief. If this checkbox is marked, you certify that the employer is eligible to use and is using the Section 4980H Transition Relief for employers with fewer than 100 employees or for employers with 100 or more employees. If you mark this checkbox, you must also specify which relief you are claiming in the Section 4980H column of the ALE Member Information - Monthly section.

- Month Begin

- Month End

- Month Day 12

- Pay Period Begin. The first day of the first pay period during the month.

- Pay Period End. The last day of the first pay period during the month.

- A. The employer is eligible for the 50 to 99 Relief.

- B. The employer is eligible for the 100 or More Relief.

This table is enabled if any of the checkboxes in the Aggregated Group column in the ALE Member Information - Monthly section are marked. Use this table to enter information about the other members of the Aggregated Group the employer belongs to. Enter the group members in descending order starting with the group member with the highest average monthly number of full-time employees.

Note

If any member of the Aggregated Group uses the 98% Offer Method, all members of the Aggregated Group should report the average monthly number of total employees rather than full-time employees.

Custom tab

This tab is visible if custom fields exist for the entity. At a minimum, if there are custom fields, a Fields subtab will be present. One or more additional categories of subtabs may also be visible.

Fields subtab

This tab prompts for values for any custom fields set up for entity records of this entity type. Respond to the prompts as appropriate.

References subtab

This tab is visible if other records reference the current record.

Example

Suppose a custom field exists on PRCodes that references an ARCode. On the ARCode record, on the Custom > References subtab, you can view all the PRCodes which reference that ARCode.

Exchange Folder subtab

This tab is visible only if you set up a custom field with a data type of "Exchange Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified Exchange folder.

File subtab

This tab is visible only if you set up a custom field with a data type of "File". The label on the tab is the name assigned to the custom field.

This tab renders the contents of the specified file according to its file type.

Internet Address subtab

This tab is visible only if you set up a custom field with a data type of "Internet Address". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified web page.

Network Folder subtab

This tab is visible only if you set up a custom field with a data type of "Network Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified network folder.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Change Logs tab

This tab is visible if the user has "Change Logs" access to the associated data folder resource.

The Change Logs pane shows the Change Logs HD view filtered to show all change logs for the selected entity record.

Double-click a row in the pane to drill down to its record in the Change Log window.

Other tab

Developer tab

This tab is visible only when developer features are enabled.

Automation subtab

This subtab shows field names and values for the current data record. Use the information in the subtab to assist when creating automation objects such as bots and import files. The field names and field values can be copied from the text box and pasted directly into your code or application. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Export (XML) subtab

This subtab shows the XML syntax for exporting the selected data record. The syntax can be copied from the text box as an exemplar for creating your own automation objects for bots, import files, ActivWebAPI, etc. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Import (XML) subtab

This subtab allows you to select a file for import and shows the XML syntax for importing data records. Use the subtab to explore the XML syntax for importing data records. In particular, you can investigate the syntax which results when using Data.Import and ActivWebAPI data POST and DELETE routes.

Change Log (XML) subtab

This subtab is visible only when the Enable Change Logs option is marked in System Options or Company Options (depending on whether the feature applies at the system or the company level). This is the default setting when developer features are enabled.

This subtab allows you to investigate changes to the current data record. The syntax can be copied for use in bots, dashboards, ActivWebAPI, and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Select Statement (SQL) subtab

This subtab allows you to investigate the SQL select statement used to retrieve the current data record. The syntax can be copied as an exemplar for data sources and other automation. To copy content from the text box, highlight the content to copy and press Ctrl+C or right-click your selection and select Copy from the context menu.

Export employers security

Common accesses available on export employers

Report Email dialog

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

Third party sick pay

Example

Excerpt from sample check:

| PRCode | Source | Result | AP Control | Groups | Debit Account | Credit Account |

|---|---|---|---|---|---|---|

| Pay.3rdSick | 685.71 | 685.71 | Compensation | 9999-00-00-A | ||

| Tax.3rdMedEE | 685.71 | 9.94 | 3rdPartySickPayMed, Medicare | 9999-00-00-A | ||

| Tax.3rdSocSecEE | 685.71 | 42.51 | 3rdPartySickPaySS, SocialSecurity | 9999-00-00-A | ||

| Tax.3rdUSA | 685.71 | 0.00 | 3rdPartySickPayTax, IncomeTax | 9999-00-00-A | ||

| Tax.MedER | 685.71 | 9.94 | 941 | Medicare | 5401-00-00-A | 2401-00-00-A |

| Tax.SocSecER | 685.71 | 42.51 | 941 | SocialSecurity | 5402-00-00-A | 2402-00-00-A |

| Ded.3rdSick | 633.26 | 633.26 | 9999-00-00-A |

Source and Result expressions for Ded.3rdSick

Source:

SumCheck.Result('Type=Pay AND Pay=3rdSick')

- SumCheck('3rdPartySickPayTax Amount')

- SumCheck('3rdPartySickPaySS Amount')

- SumCheck('3rdPartySickPayMed Amount')

Result:

Source

Noteworthy:

- Pay.3rdSick, Tax.3rdMedEE, and Tax.3rdSocSecEE, and perhaps Tax.3rdUSA, are input after-the-fact from the third-party claim.

- 3rdMedEE and 3rdSocSecEE have normal source expressions for wages, but a null result expression for entering the claim amount.

- Tax.3rdUSA has a normal source for taxable wages, but the result is blank or zero. This line is needed for taxable wages, even if the third-party payer did not deduct it (this is also true for state taxes).

- Employee-paid taxes in both the normal groups and the third-party groups.

- W-2 forms. Since they are in normal taxable groups, third-party totals are included in wage and withholding amounts on W-2 forms. Moreover, the third-party checkbox is marked on the W-2 if either the Third Party Sick Pay checkbox is marked on the employee record or the third-party Social Security or Medicare withholding amount is greater than zero.

- USA Tax Liability Report. Mark the Subtract Third-party Sick Pay checkbox to report your company's tax liability only. Clear the checkbox to include taxes paid by third parties.

- Form 941. Third-party sick amounts are reported on Form 941.

- There is no AP control for employee-withheld social security, Medicare, and income tax since these are paid by the third-party payer.

- Normal MedER and SocSecER are used for amounts the employer owes. These are assigned to an AP control.

- Ded.3rdSick reduces net pay to zero.

Sample Check GL Detail Report

Note the suspense account is used for 3rdMedEE, 3rdSocSecEE, 3rdUSA, and Ded.3rdSick.

| Accrual | ||||

| 9999-00-00-A | Suspense | 08/19/2023 | 685.71 | |

| 5401-00-00-A | Medicare Tax | 08/19/2023 | 9.94 | |

| 5402-00-00-A | Social Security Tax | 08/19/2023 | 42.51 | |

| 9999-00-00-A | Suspense | 08/19/2023 | 738.16 | |

| 738.16 | 738.16 | |||

| Liability | ||||

| 9999-00-00-A | Suspense | 08/19/2023 | 738.16 | |

| 9999-00-00-A | Suspense | 08/19/2023 | 685.71 | |

| 2401-00-00-A | Medicare Payable | 08/19/2023 | 9.94 | |

| 2402-00-00-A | Social Security Payable | 08/19/2023 | 42.51 | |

| 738.16 | 738.16 | |||

| Cash | ||||

| 9999-00-00-A | Suspense | 08/19/2023 | 0.00 | |

| 9999-00-00-A | Suspense | 08/19/2023 | 0.00 | |

| 0.00 | 0.00 | |||

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |